Investing in Energy: The time is now, and the place is the Midwest

Also posted on Midwest Energy News

In part I of our series we revealed how the Midwest, with its world-renowned Universities and research labs, has all the right intellectual capital to kick-start an energy tech revolution. The next step is pairing these great ideas with the right financial capital, and there are serious investment dollars transforming raw potential and innovation into viable businesses in the region.

It’s not a coincidence that Chicago’s first Venture Summit will be held this October—the city has seen a significant increase in tech startup investment. Built In Chicago reported $311 million was invested in startups last quarter, double the level from that period a year ago. And Chicago’s not the only place this is happening.

One of the more recent gems is the story about Mark Kvamme and Chris Olsen, partners at Sequoia Capital who left Silicon Valley to start Drive Capital, a $250 million fund in Columbus, Ohio (which, by the way is the second largest inaugural fund raised nationally in the last year). Kvamme told Forbes that he and Olsen, “truly believe the best place in America to build your company is in the Midwest.”

We agree.

With a blossoming entrepreneurial ecosystem, the level of investment in the region is on an upswing. Of course, there may always be some skepticism surrounding “cleantech” investing, given the losses sustained by venture capitalists and government agencies alike, but there’s also tremendous learning that comes from that experience. Though it seems counterintuitive, the decline of investment dollars into energy is a massive opportunity. Here’s why:

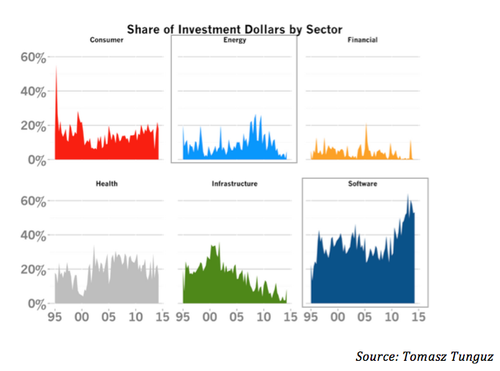

One look at the graph above and it’s obvious that software is the industry investors are trying to capitalize on in 2014. But for an industry at its peak, valuations, as well as the risk of falling hard and fast, are high. The drop in energy investment activity might suggest it’s an industry to avoid, but this “undervalued” market is a huge opportunity to take advantage of low valuations in an industry whose overall value remains high. The global market value for the software industry is huge ($1.5 trillion in 2013), but it doesn’t compare to an industry whose value is almost 6 times the size: the $6 trillion energy industry.

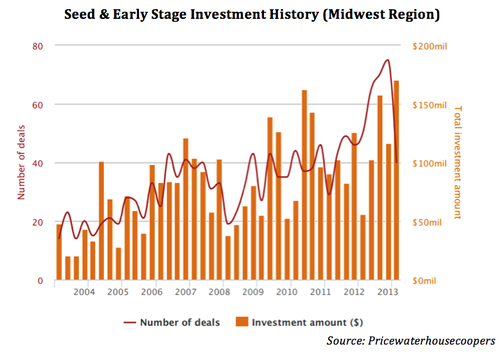

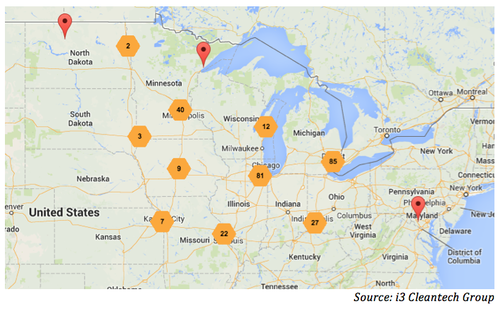

Also, the number of potential energy investment opportunities that exist in the region still exceed the dollars available, an attractive balance of supply and demand. In the last five years, 18% of all capital invested in seed and early stage energy ventures was in the Midwest, led by a strong assembly of VC investors. This translated into financings for at least 290 Midwest energy technology companies.

Huron River Ventures (Ann Arbor, MI) has a focus on energy, transportation infrastructure, and agriculture and last spring, joined Energy Foundry and Manasota Capital in an investment in Root3 Technologies, a predictive analytics engine that reduces costs in onsite energy plants for universities, airports, hospitals, and manufacturing facilities by 10-30%.

The region is also starting to see some success stories. For example, Wisconsin-based Venture Investors first invested in Chromatin, a biotech company developing sorghum for traditional agriculture and for applications in renewable energy. Chromatin has raised $60 million and just a few weeks ago, they announced their acquisition of Production Seeds Plus, Inc., which will more than double Chromatin’s storage and seed handling facilities.

SoCore Energy, a commercial solar company, was originally supported by Chicago-based I2A fund (now Chicago Ventures). After a $4M growth equity round with other Chicago VCs Lightbank and 7wire Ventures, SoCore announced they were acquired by California’s Edison International, allowing them the resources to grow. Expansions and operations remain in Chicago.

With the buzz of all this activity—new deals, acquisitions, and new funds—it’s hard for us to even muster the idea that cleantech is “past its prime.” Instead, we think of it as “cleantech 2.0.” And Midwest investors are doing it differently this time around.

The innovation exists. The capital is starting to flow. The appetite for energy exists. And collaborations between entrepreneurs, labs, universities, incubators, investors, and corporations are on the rise. It’s with these collaborative principles in mind that Energy Foundry, and the co-working space we reside in, Coalition: Energy, were founded.

Next in this series, we’ll address the third catalyst for the revolution—the Midwest-based corporations and Fortune 500 companies embracing innovation and driving commercialization.